AP CFMS: Implemented by Andhra Pradesh Centre for Financial Systems and Services (APCFSS), CFMS is an enterprise-level application. AP CFMS stands for Andhra Pradesh Comprehensive Financial Management System and the broad outcomes expected from the implementation of the CFMS project include a “One Source of Truth” throughout the Enterprise (Government) accessible to all program participants, access to real-time information, ease of decision-making, speed and delivery of services, facilitation of all stakeholders, minimum reconciliation and financial development in Government.

|

| AP CFMS |

Vision Of AP CFMS

- Efficiency does the RIGHT thing and in the context of the CFMS solution indicates results direction, prioritization and efficient use of resources, control and monitoring, timeliness and policy support.

- Stakeholder benefit means that participants (departments, departments, auditors, staff, pensioners, citizens, suppliers, contractors, teams, etc.) see the benefits in implementing the plan.

- Efficiency does the right thing and in the context of the CFMS solution defines speed, accuracy, consistency and reliability, minimal interface and return to investment

- The business model means that the CFMS solution will be based on a comprehensive process that breaks the bar/details of departmental services in order to facilitate decision-making taking into account the overall perspective of the situation.

- Transparency is stated in the timely and accurate dissemination and disclosure of information, data and decision-making processes to relevant stakeholders.

You may want to read this post :

UP Domicile Certificate Download Online @ Edistrict.Up.Nic.In

Services Of CFMS

- Government to Government (G2G)

- Government to Citizen (G2C)

- The Government to Employee (G2E)

- Government to Business (G2B)

How To Use CFMS Services

- Click here to visit the official website of CFMS. After clicking, you will be landed to the homepage of the official website

- Scroll the page and find the “Services” section, at the bottom of the page

- Select the services you want to use

- Submit your details

- After submitting your details, you will get further details to use your desired service

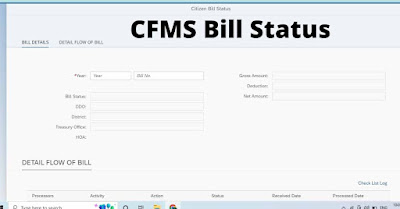

CFMS Bill Status

Check CFMS Bill Status:

- Click here to visit the official website of CFMS. After clicking, you will be landed on the homepage of an official website

- On the homepage, you will find a “Citizen Services” column with expandable links. Hover your mouse there

- Now you will see the “Bill Status” link there. Click on it

- Now you will be redirected to the CFMS Bill Status page where you will be asked for a few details- Year and Bill Number

- Submit these details and click on the enter button

- Your CFMS Bill Status will be on your computer screen.

(SBI Samadhaan App Download) How to Download Quick SBI Samadhaan App for Android

CFMS ID – CFMS Beneficiary Search

- Click here to access the direct link to the AP CFMS ID Search page

- After clicking on this link, you will be landed in the CFMS ID Search

- On the new page, you have to choose an option by which you want to search your CFMS ID or CFMS Beneficiary

- You select any of these available options- Aadhar card, PAN card, Bank Account, Beneficiary number, Request number

- Enter the number of your selected option and click on the Search button

- Your CFMS ID or CFMS Beneficiary will be on your computer screen

- These details will be mentioned there- Beneficiary code, Name, Address, Aadhar number, PAN number, GSTIN number and Bank account number.

Scope Of Comprehensive Financial Management System

- #1 Improved Financial Management by developing a seamless monitoring system (at a wider level of business) targeted revenue, collection/refund and real-time monitoring that enables greater control of unstructured and streamlined revenue collection through e-receipts to Government, broader access and minimal reconciliation by ensuring a single source of information.

- #2 Co-management through the various FD phases and other Government Departments to ensure a reduction in budget adjustments and the timing of the latest data distribution for this year which is expected to take place next year; the availability of real-time budget support and monitoring system support; reducing duplicate and non-productive work involves re-using paper use, and more control over fake drawls.

- #3 Improved credit management and investment management that will enable real-time access to credit information, loans, investments and outstanding guarantees in Government / Department / sub-offices and PSElevel including the complete management of the credit/loan life cycle, guarantees and investments.

- #4 Advanced Methods & Systems Management that may include real-time decision-making processes for key FD staff including a system that facilitates cash flow and financial management as well as minimal/timely reconciliation.

- #5 Improved Human Resource Management that can allow real-time observation for employees of various categories and facilitate their retirement from managing life cycle events; pension management and wage management.

- #6 Advanced Accounts Management can include:

- One source of information meets the analytical needs of all stakeholders;

- FD to have all the details about Government Accounts from its sources;

- Minor reconciliation between AG, Treasurer, Government Departments, Banks etc .;

- Real-time account availability – to ensure the prompt completion of monthly and annual accounts;

- Rare / risk-based audits and the evaluation and recruitment of draft audit structures that allow for timely and effective auditing;

- Paper crafts/craftsmanship; and

- Performing employee and debt-related debit information through multiple delivery channels

- #7 Improved Cost Management that can include:

- Real-time monitoring of all payments on monthly/quarterly/annual budgets;

- 100% budget management without causing difficulty for participants;

- One source of truth in terms of cost;

- Paper crafts / craftsmanship;

- Extensive control of misclassification;

- Workflow automation with the provision of targeted physical monitoring of financial progress;

- Allocation of cost management responsibility at the departmental level;

- Specified credit flow that ensures equitable distribution of work at all times;

- Decreased difficulty in the introduction/implementation of debt at the DDO level;

- Previous research focused on capital expenditure;

- Advanced authentication systems use Aadhaar based Biometrics and digital signature services; and

- Adequate system for monitoring PD accounts